The overall market was stable, fluctuating within a narrow range, and no major changes occurred; Baosteel increased its prices, while other private steel mills remained stable for the time being;

1. Market situation of hot-rolled coils, raw materials for tinplate

The market demand for hot-rolled coils has cooled down, and the demand has weakened. The overall supply from steel mills has remained stable. The cooling of the market has not affected the confidence of the market and steel mills, and the overall situation remains stable. At the same time, affected by the news of national production restrictions, futures prices have risen, and it is expected that the overall market will fluctuate in a narrow range.

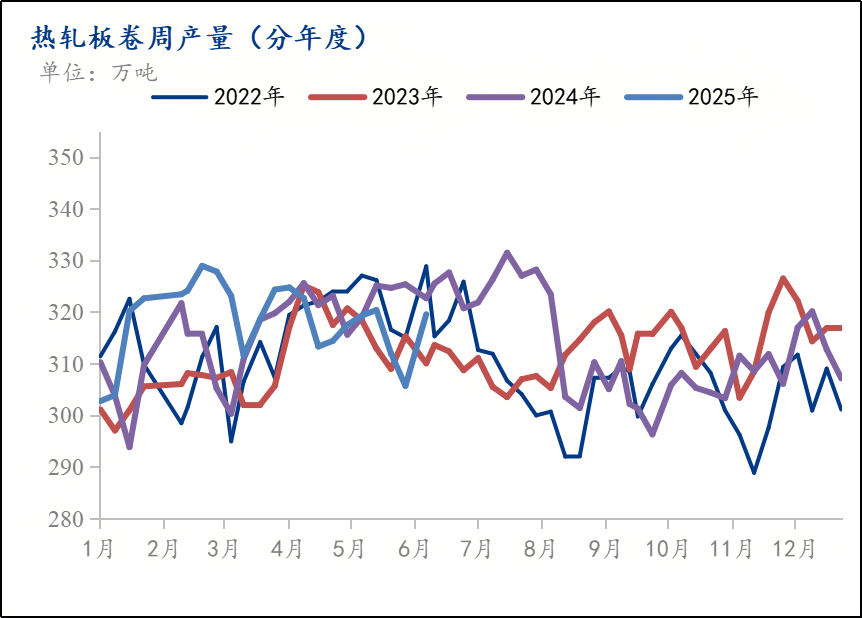

In June, the price of hot-rolled coil fluctuated between 3210-3250 yuan/ton, with a slight increase in price. Demand has recovered to a certain extent compared with May, supply has gradually recovered, and the inventory inflection point has appeared. It is expected that in July, under the condition of weak demand and high supply of hot-rolled coil, the contradiction between supply and demand may expand again. At the same time, under the mutual influence of macroeconomic policies, the market price may show a wide range of fluctuations. In June, the total output of hot-rolled coil sample steel mills was 13.0609 million tons, the final inventory value was 2.6294 million tons, and the apparent demand was 3.1306 million tons. The demand has declined to a certain extent compared with May, and the price support capacity is weak.

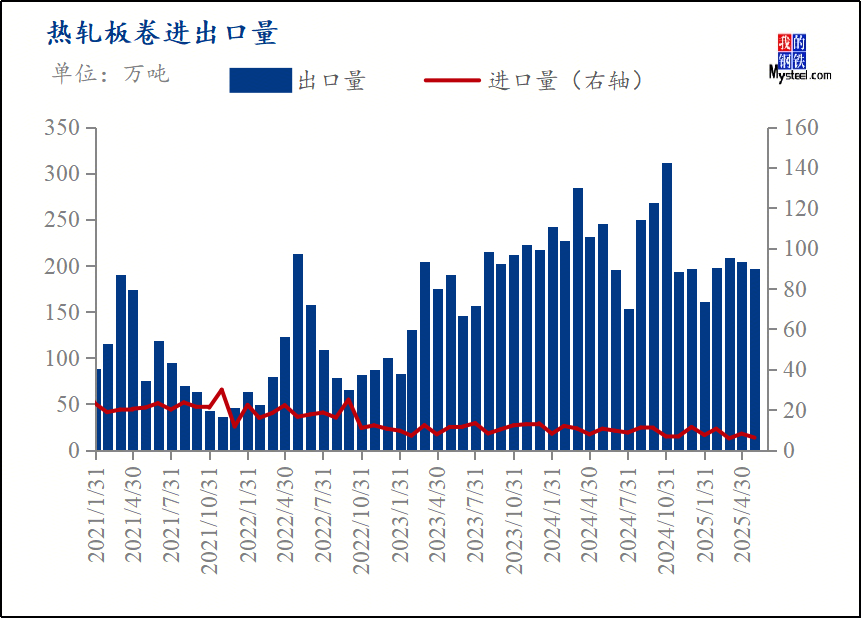

In May, the export volume of hot-rolled coils was 1.9147 million tons, down 3.84% from the previous month; the import volume of hot-rolled coils was 61,900 tons, down 23.90% from the previous month. At present, both import and export volumes have dropped significantly, and the export enthusiasm may cool down.

As of June 30, the national average price of 4.75 hot-rolled coil was 3,244 yuan/ton, up 20 yuan/ton from the previous trading day. The prices in major cities were 3,220 yuan/ton in Shanghai;

2. Changes in the tinplate market

The tinplate market is generally stable, with average demand. The market remains cautious about the future market, and it is expected that the price of tinplate will remain slightly volatile.

Tinplate price changes

BAOSTEEL (BAOSHAN, MEISHAN, WINSTEEL) tin-plated and chrome-plated product prices increased by 100 yuan/MT;

Prices of other major market suppliers remained unchanged;

Some private factories reduced prices by 50-100 yuan/MT, then withdrew the discount and maintained the original price;

Hot-rolled price changes

SHASTEEL, hot-rolled price remains unchanged;

HBIS, hot-rolled price remains unchanged;

Shousteel, hot-rolled price remains unchanged;

Ansteel, hot-rolled price remains unchanged;

Bensteel, hot-rolled price remains unchanged;

Recent price changes

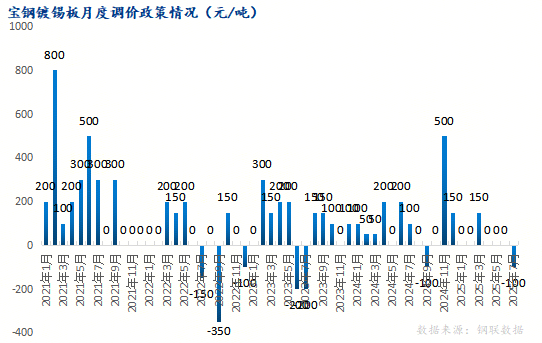

From the perspective of the steel mill tinplate price adjustment policy, the ex-factory prices of private enterprises in June generally decreased by 50-100 yuan/ton. In June, the settlement price of Hebei hot-rolled coil was SPHC3170 yuan/ton, down 80 yuan/ton month-on-month. In July 2025, the base price of Baoshan electroplated tin (chromium), Meishan, and Wuhan Iron and Steel Nippon Steel electroplated tin products will be reduced by 100 yuan/ton based on the June 2025. The futures guidance price remains unchanged in August.

From the perspective of the steel mill tinplate price adjustment policy, the ex-factory prices of private enterprises in June were generally reduced by 50-100 yuan/ton, and the mainstream ex-factory price was 5100-5400 yuan/ton. In June, the settlement price of Handan Xing hot-rolled coil was SPHC3170 yuan/ton, down 80 yuan/ton month-on-month. In July 2025, the base price of Baoshan electroplated tin (chromium), Meishan, and Wuhan Iron and Steel Nippon Steel electroplated tin products will be reduced by RMB 100/ton based on the base price in June 2025. The guidance price for futures in August has not been released, and it is expected that the fluctuation will not be too large.

From the raw material side, the cost center of tinplate hot-rolled base material may continue to decline in a narrow range, and the price of tin ingots will remain high and fluctuate, which will provide certain support for the spot price of tinplate. From the supply side, the current production rate of private production enterprises is maintained, and the actual ex-factory price may remain weak and stable after the previous compression, and the delivery period of futures orders is mostly 40-60 days. From the demand side, the current market rigid demand is maintained, and foreign trade orders are still showing an upward trend. The pace of subsequent autumn order demand release is slow, and spot prices remain volatile. Traders are cautious but not pessimistic about the future market, and overall maintain standing inventory.

In summary, the supply and demand of the tinplate market in July basically maintained a weak balance, and the relevant market conditions still need to be watched.

3. Tinplate market related situation

3.1 Tinplate enterprise production start-up situation

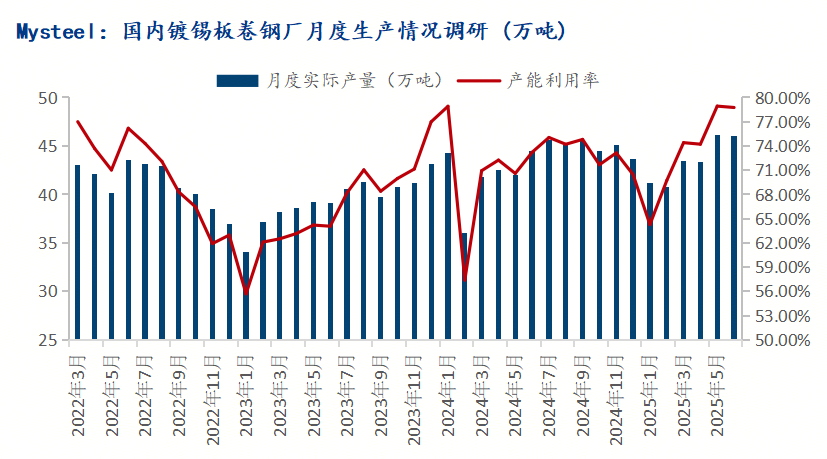

According to the key tinplate production enterprises monitored by Mysteel, the start-up rate in June 2025 was 78%, and the capacity utilization rate was 78.75%; the actual output of tinplate in June was 460,200 tons, a decrease of 1,000 tons from the previous month, and the factory inventory was 195,900 tons, a decrease of 2,300 tons from the previous month; in addition, Mysteel’s survey data on key domestic chrome-plating production enterprises showed that the output of chrome-plated plates in June totaled 140,200 tons, an increase of 3,000 tons from the previous month.

3.2 Tinplate export situation

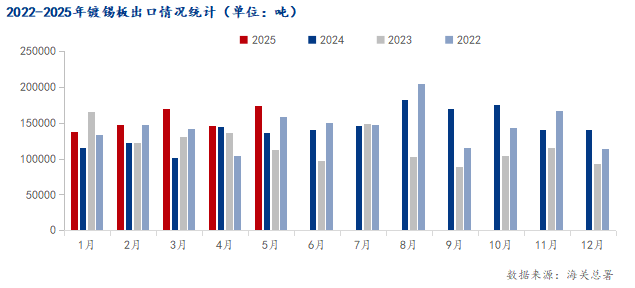

In May 2025, China’s total tinplate exports totaled 173,600 tons, a year-on-year increase of 27.77%; from January to May 2025, China’s total tinplate exports totaled 774,200 tons, a year-on-year increase of 24.83%.

In May 2025, China’s total chrome-plated plate exports totaled 57,900 tons, a year-on-year increase of 51.24%; from January to May 2025, my country’s total chrome-plated plate exports totaled 260,500 tons, a year-on-year increase of 56.92%.

On the whole, the export volume in January-March 2025 increased significantly due to the early order acceptance in anticipation of tariffs, and the total export volume in April was basically maintained. In May, the total export volume continued to increase under the stimulation of macro news.

3.3

3.4 Downstream metal packaging market situation

According to the data from the National Bureau of Statistics, from January to May 2025, the output of beverage manufacturing enterprises above designated size nationwide reached 74.6 million tons, a year-on-year decrease of 4.77%. Among them, the output of beverages in May was 16.131 million tons, a year-on-year decrease of 6.14%.

According to the data from the National Bureau of Statistics, from January to May 2025, the output of dairy products was 11.776 million tons, a year-on-year decrease of 0.83%. Among them, the output of dairy products in May was 2.433 million tons, a year-on-year increase of 3.27%.

3.5 Shougang Jingtang successfully produced 0.6mm ultra-thick tinplate, breaking through the design upper limit of 0.55mm and achieving a key technological breakthrough. This achievement marks an important breakthrough in Shougang’s high-end plate manufacturing. This new product has high strength and strong corrosion resistance, and can be widely used in high-end fields such as automotive parts and industrial electronics, with broad market prospects.

4. International market news related to tinplate

4.1 Russian billet export prices continued to weaken, mainly due to weak demand in the Turkish and Egyptian markets. The Black Sea export index was reported at $440/ton FOB, down $2/ton from last week.

4.2 On July 4, 2025, the Management and Executive Committee of the Brazilian Foreign Trade Commission (GECEX) issued Resolution No. 755 of 2025, deciding to continue to impose anti-dumping duties on circular welded austenitic stainless steel pipes originating in China for a period of 5 years;

4.3 In the first five months of 2025, Turkey’s hot-rolled coil imports reached 1.58 million tons, a year-on-year decrease of 10.4%; the import value was US$882 million, a year-on-year decrease of 22.8%. Despite the overall slowdown in imports, the monthly import volume in May reached 513,000 tons, a surge of 124.7% month-on-month and an increase of 81.2% year-on-year, and the import value increased by 111.3% month-on-month. In terms of import source countries, China is still Turkey’s largest source of hot-rolled coil imports, supplying 640,000 tons in the first five months, a year-on-year decrease of 28.5%;

4.4 According to industry news, South Korea recently officially announced that it would impose anti-dumping duties on stainless steel plates originating from China for a period of five years starting from 2025. The products involved are medium-thick stainless steel flat plates with a thickness of 4.75 mm and above and a width of 600 mm and above. As early as late May, South Korea had launched another round of anti-dumping measures against thin-gauge (thickness not exceeding 8 mm) stainless steel flat-rolled products produced in China, Indonesia and Taiwan, China, with the tax rate for Chinese products ranging from 23.69% to 25.82%.

4.5 International market price reference

Southeast Asia

Malaysia’s SAE1006 hot coils exported to Vietnam are quoted at $495/ton CFR, which is stable week-on-week.

In the Vietnamese plate market, the price of Q235 is $462/ton, which is about $5/ton higher than the previous week. The transaction is in a relatively stable state, and the price is expected to rise next week.

The FOB price of 3mm SAE1006 hot coils from Indonesian steel mills is $500/ton CFR;

Middle East

The import quotations in the UAE market are generally under pressure: China’s cold coils are quoted at $540-550/ton CFR, and India previously quoted at $580-590/ton CFR, but there is a lack of new quotations. China’s 1mm and Z275 hot-dip galvanized are quoted at $650-660/ton CFR, and India’s are $710-720/ton CFR, and there are no large transactions for the time being. Market participants generally said that due to the unstable political situation and the delayed pace of post-holiday purchases, the overall wait-and-see sentiment was strong.

The Saudi plate market continued to be sluggish, and China’s 1.2mm hot coil price remained at US$520-530/ton CFR, but there was little news of transactions.

India

Affected by the seasonal off-season, the Indian hot coil market continued to consolidate weakly. In the short term, the weak recovery of terminal demand and high inventory will continue to fluctuate around 50,000 rupees/ton (about US$586/ton) to bottom out.

Europe and the United States

The European hot-rolled coil market continued to be sluggish, and prices remained almost unchanged. Buyers’ strong wait-and-see sentiment formed a game with suppliers’ cost pressure. The daily hot coil in the Nordic region was 555.83 euros/ton (equivalent to US$653.43)

The Italian market also performed weakly, with hot coils at 533.33 euros/ton.

The United States

The hot-rolled coil market in the southern United States has become more popular, and prices have risen for four consecutive months. This week, the market continued to react to rising steel prices due to the escalation of Section 232 tariffs. On July 2, the price of hot-rolled coils from steel mills in the southern United States reached $893.60 per short ton, or about $984.93 per ton.

(Information reference @mysteel)

5. Opportunities and difficulties in the fierce competition trend

As of now, more and more tariff barriers have had a significant impact on the circulation of tinplate and related products, and changed the costs of local production enterprises; local enterprises have to follow policy changes, change procurement sources, and accept higher costs; at the same time, the demand side cannot accept price increases due to tariffs and cost changes, and due to global oversupply, the demand side continues to demand price cuts and increase payment cycles, causing tinplate can manufacturers to be under pressure.

Since 24 years ago, we have received the needs of many companies to reduce costs; we have solved some of the pressure for customers by supplying can lids and bottoms:

5.1 The production cost of products is reduced, avoiding the impact of tinplate tariffs;

5.2 Improve product quality;

5.3 Reduce financial pressure;

5.4 Reduce equipment purchase and maintenance costs;

Contact us now, we can provide you with solutions for your reference, so that your brand can be one step ahead in the market!