1. Raw Material Price Changes

Tinplate:

Major steel mills such as Baosteel, WISCO, MEISTEEL, SHOUGANG have kept their prices unchanged.

Prices at other mills showed slight fluctuations, primarily in the direction of maintaining current levels.

Some mills adjusted their tin coating surcharge. While the base opening price remained unchanged, the tin coating surcharge increased by 30 to 100 RMB/ton, achieving a mild price hike.

Hot-rolled Coil:

Major mills like BAOSTEEL, WISCO, and MEISTEEL raised prices by 100 RMB/ton. It is anticipated that the overall market will follow this raw material price increase trend, warming up for the next tinplate price hike.

2. Analysis of Factors Affecting Tinplate Prices

2.1 Hot-rolled coil prices continue to fluctuate with an upward bias

In November and early December, hot-rolled coil prices in some markets initially dropped by 150 RMB/ton, then subsequently rose by 210 RMB/ton. Quotations in other markets remained largely stable or showed minimal fluctuations, with negligible impact, essentially flat overall.

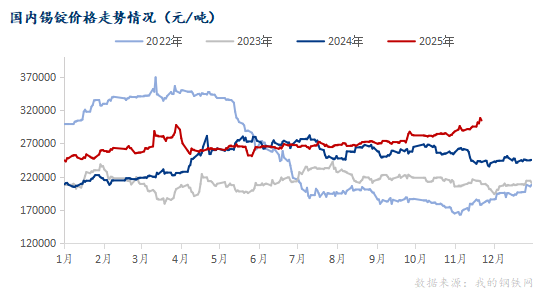

2.2 Changes in the Tin Ingot Market

The spot price of tin on the Shanghai market was reported at 300,000 RMB/ton, a month-on-month increase of 15,750 RMB/ton. The average price in November was 290,438 RMB/ton, up 7,761 RMB/ton month-on-month. According to Mysteel calculations, the average tin cost for producing one ton of tinplate (using 0.2mm thickness, double-sided 2.8g coating) is approximately 1,067.75 RMB/ton of steel, with the tin ingot cost increasing by 28.53 RMB/ton month-on-month.

Domestic Tinplate Substrate Composite Price Index (RMB/ton)

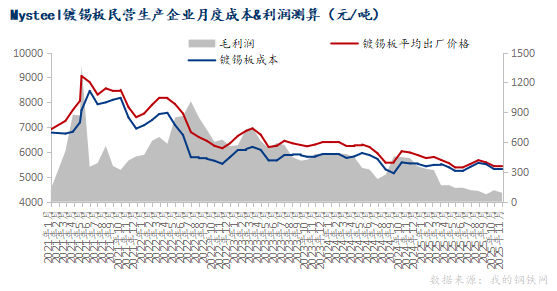

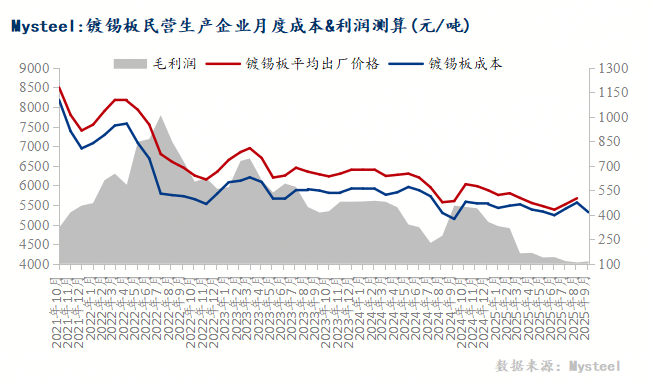

2.3 Reference for Profitability Estimation of Private Tinplate Producers

In November 2025, the production cost of tinplate decreased by 4 RMB/ton month-on-month, with a gross profit of 89 RMB/ton, down 26 RMB/ton month-on-month. The overall profitability for integrated enterprises remains relatively good.

Monthly Cost & Profit Calculation for Private Tinplate Manufacturers (RMB/ton)

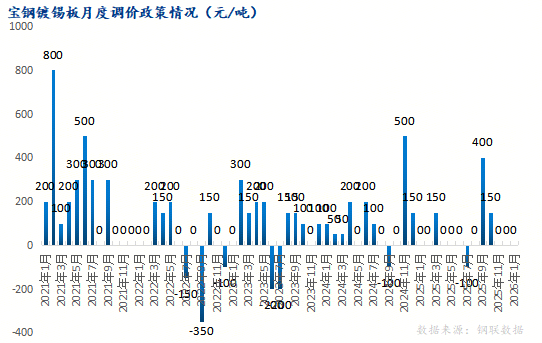

2.4 Situation of Main Flag-bearing Suppliers

For January 2026, the prices for Baoshan Electrolytic Tinplate (Chromium), Meishan, and Wuhan Iron & Steel Nippon Tinplate products will maintain the base price unchanged from December 2025, with adjustments made to the tin quantity surcharge.

Baosteel’s Monthly Price Adjustment Policy for Tinplate (RMB/ton)

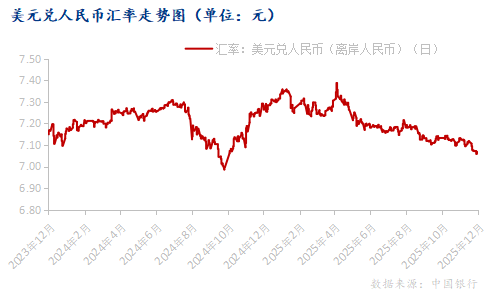

2.5 USD to CNY Exchange Rate Leading to Rising Export Prices

This week, the CNY exchange rate continued to depreciate week-on-week. This trend is expected to persist, with the possibility of significant exchange rate fluctuations, thereby indirectly affecting price increases for USD-denominated commodities.

USD to CNY Exchange Rate Chart (unit: yuan)

3. Peripheral Market Information

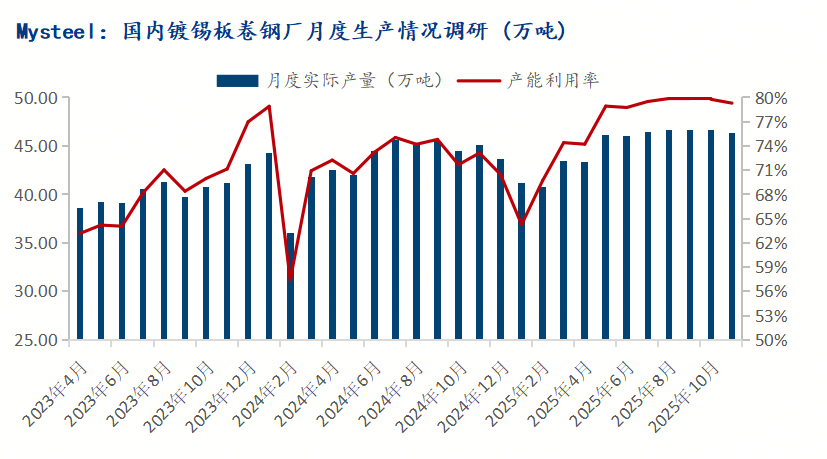

3.1 According to Mysteel’s monitoring of key tinplate producers, the operating rate in November 2025 was 78%, and the capacity utilization rate was 79.29%. Actual tinplate production in November was 463.4 thousand tons, a decrease of 2.7 thousand tons month-on-month. Inventories at the same sample plants were 197.7 thousand tons, a slight increase of 0.02 thousand tons month-on-month. Furthermore, Mysteel’s survey data on key domestic TFS (Tin Free Steel) producers shows TFS production in November totaled 150.5 thousand tons, a marginal increase of 3.2 thousand tons month-on-month.

Monthly Production Survey of Domestic Tinplate and Coil Steel Mills (10,000 tons)

3.2 Tinplate Foreign Trade Market Data

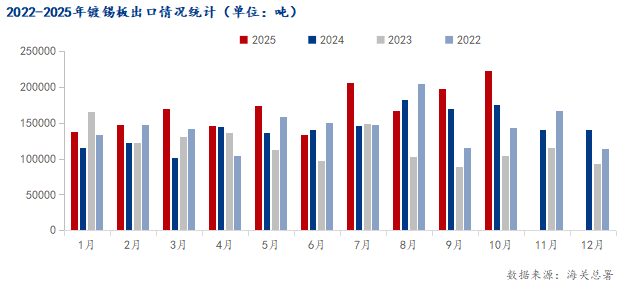

China’s total tinplate exports in October 2025 amounted to 222.6 thousand tons, a year-on-year increase of 27.50%. Cumulative tinplate exports from January to October 2025 totaled 1.70 million tons, up 18.68% year-on-year. Tinplate imports in October 2025 were 269 tons, a year-on-year decrease of 32.33%. Cumulative imports from January to October 2025 were 3,873 tons, down 78.89% year-on-year.

Overall, new international geopolitical frictions in October exceeded expectations, yet tinplate exports continued their growth trend. It is anticipated that foreign trade data will perform well in the fourth quarter.

Statistics on Tinplate Exports 2022-2025 (unit: tons)

4. Downstream Market Information

4.1 According to data from the National Bureau of Statistics, from January to October 2025, the output of beverage manufacturing enterprises above designated size nationwide reached 155.501 million tons, a year-on-year decrease of 4.40%. Specifically, beverage output in October was 10.962 million tons, down 7.94% year-on-year.

4.2 According to data from the National Bureau of Statistics, from January to October 2025, dairy product output was 24.416 million tons, a slight year-on-year decrease of 0.34%. Dairy product output in October was 2.762 million tons, down 5.51% year-on-year.

5. Brief Analysis of the Chinese Tinplate Market

Overall: As of 2025 year-to-date, tinplate and TFS capacity continues to increase, the average spot ex-factory price has fallen by 8%, the average profit for private producers has decreased by 218 RMB/ton, while total tinplate exports in the first three quarters grew 17.46% year-on-year, and TFS exports grew 36.69% year-on-year.

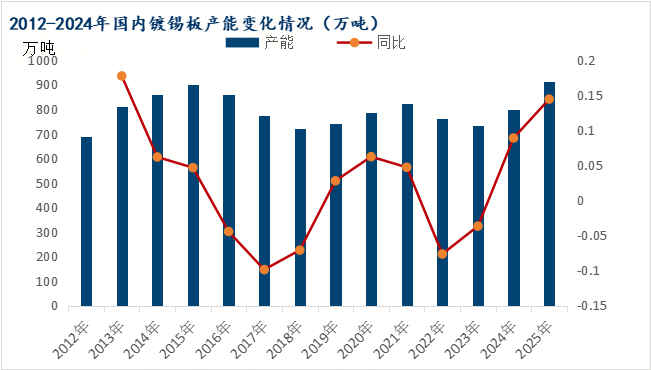

5.1 Continuous Capacity Expansion

Statistics as of November 2025 show China’s effective tinplate and TFS capacity reached 10.98 million tons, an 11% year-on-year increase. New capacity added this year amounts to 1.35 million tons across 6 production lines, while cumulative capacity elimination in recent years totals 3.12 million tons.

Changes in Domestic Tinplate Production Capacity from 2012 to 2024 (10,000 tons)

5.2 Forecast for Market Capacity Changes in 2026

It is estimated that a total of 4 new tinplate production lines will be added in 2026, with capacity around 1 million tons, concentrated for commissioning in the second half of the year. Additionally, there are 10 approved but not yet constructed project lines, with an estimated capacity of 2.2 million tons.

5.3 Foreign Market Demand is the Primary Growth Driver

The significant growth in both capacity and output is attributed partly to the concentrated release of some new capacity and increased utilization rates of existing lines, and partly to the continued strong performance of China’s tinplate foreign trade orders. Statistical data shows that from January to September 2025, China’s total tinplate exports were 1.4774 million tons, a 17.46% year-on-year increase, and TFS exports were 430.7 thousand tons, a 36.69% year-on-year increase. Based on current estimates of overseas orders from various producers, China’s annual tinplate exports may grow by around 18% for the full year, with total exports potentially reaching as high as 2 million tons; TFS exports may grow by around 35%, with total exports potentially reaching as high as 600 thousand tons. Foreign trade demand remains the main driver for tinplate and TFS consumption in China.

5.4 Tonnage steel gross profit for tinplate producers has gradually narrowed this year, even turning negative for some, with overall profits at low levels. Changes in tinplate production costs and profits are determined by fixed costs in the processing stages and variable prices of raw and auxiliary materials. Processes such as pickling, rolling, tempering, drawing, degreasing, annealing, and electroplating are relatively stable. Cost changes depend more on fluctuations in the prices of raw materials, specifically hot-rolled coil and tin ingots.

Monthly Cost & Profit Calculation for Private Tinplate Manufacturers (RMB/ton)

5.5 Market Outlook

In 2026, China’s tinplate market may present a pattern of “low supply growth, high and fluctuating costs, and sustained pressure on profits,” with foreign trade demand becoming a key variable alleviating overcapacity.

Constrained by industry saturation, the actual pace of new project commissioning may slow down, with production growth potentially continuing at a moderate rate of 3%-5%, primarily reliant on export order support. Tinplate substrate prices may continue fluctuating due to the steel industry cycle, while tin ingot costs face upward risks due to supply-demand dynamics. Tinplate export volume is expected to maintain 15%-20% growth, driven mainly by demand growth and an increasing proportion of food-grade product exports.

6. Facing the upcoming major holiday periods in December, January and February, coupled with cycles of intensive fiscal year-end and annual policy releases, market changes will become increasingly unpredictable. How can we mitigate the risks and volatility losses from market fluctuations for long-term orders and agreements with downstream customers?

We can offer long-term agreements. At the moment an order is locked in, we can guarantee a fixed price through domestic raw material hedging operations, helping your team avoid market volatility.

Please feel free to communicate with us regarding any plans.

DATA FROM@mysteel.com