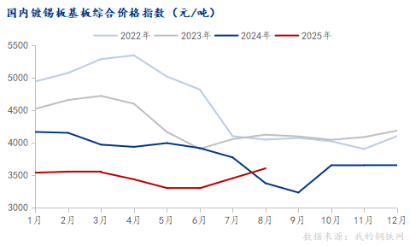

1. Tinplate Price Adjustments

- BAOSTEEL, WINSTEEL, MEISTEEL: price increase of USD 20/MT.

- Other tin mill plants: price increase of USD 15-20/MT.

Hot-Rolled Coil Materials

Major steel mills (Baosteel, WISCO, Shougang, Ansteel, Bengang, Lingang, etc.) raised prices by USD 20/MT.

Order status:

Benefiting from strong overseas demand, major domestic steel mills are currently fully booked with delivery times extended to 50–60 days. Shougang’s U.S. orders and Baosteel’s European orders are especially strong, reinforcing market confidence and supporting continued upward price trends.

2. Market Updates

- Tinplate production costs continue to rise.

Hot-rolled coil prices rose by another USD 15/MT.

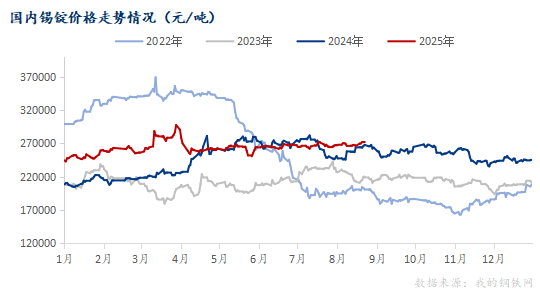

- Tin ingot prices increased by USD 220/MT.

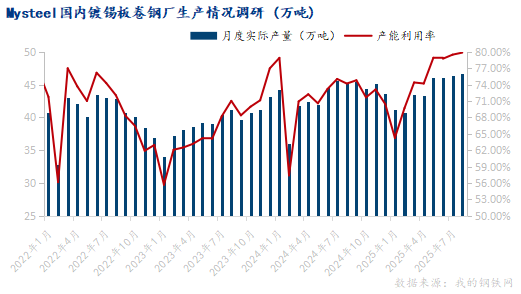

- Tinplate capacity expansion:

According to Mysteel, tinplate mill utilization rate reached 79.86% in August 2025, up 0.37% MoM. Actual production was 466,700 MT, up 2,200 MT MoM.

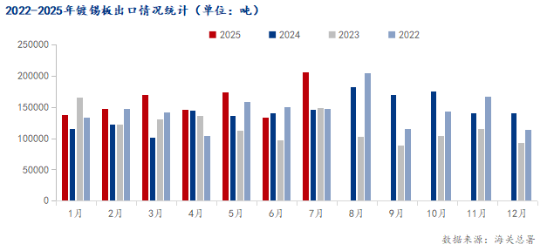

3. International Tinplate Market

- China’s tinplate exports:

July 2025: 206,000 MT, up 41.28% YoY.

Jan–Jul 2025: 1.113 million MT, up 22.79% YoY.

- China’s TFS (tin-free steel) exports:

July 2025: 39,800 MT, up 5.33% YoY.

Jan–Jul 2025: 342,400 MT, up 48.56% YoY.

June exports saw a slight decline after front-loaded shipments, but growth resumed in July, reflecting solid foreign demand.

- China’s beverage industry (NBS data):

Jan–Jul 2025: 111.01 million MT, down 4.68% YoY.

July 2025: 17.966 million MT, down 0.17% YoY.

- China’s dairy industry (NBS data):

Jan–Jul 2025: 16.592 million MT, roughly flat YoY.

July 2025: 2.206 million MT, down 2.39% YoY.

- Brazil’s anti-dumping ruling:

On Aug 29, 2025, Brazil’s Foreign Trade Executive Management Committee (GECEX) issued Resolution No. 765, imposing 5-year anti-dumping duties on Chinese tinplate and TFS of any width with thickness USD 284.34–499.35/MT (HS codes: 7210.12.00, 7210.50.00, 7212.10.00, 7212.50.90). Effective immediately.

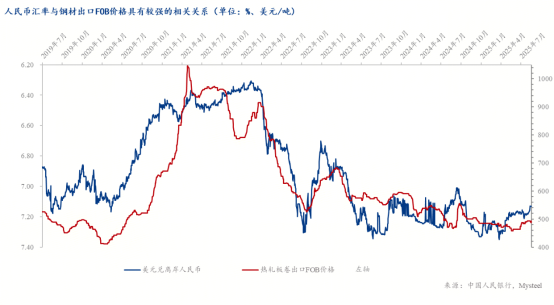

4. RMB Exchange Rate Impact

- USD/RMB has moved from 7.2 to 7.1, and with the Fed’s rate cut expectations, further appreciation is possible.

- Historically, RMB appreciation significantly impacts FOB export pricing.

- Continued RMB appreciation is expected to become a major factor pushing tinplate product prices higher.

5. Q4 Market Outlook

- Entering Q4, China’s peak tinplate consumption season, boosted by Mid-Autumn Festival, National Day, and Chinese New Year holidays.

- Based on past experience, the government may implement production cuts for pollution control, further tightening supply and supporting higher prices.

In the face of market fluctuations and uncertain trade policies, we strongly recommend paying attention to TIN CAN LIDS & ENDS as a solution. These products have successfully helped many of our partners mitigate tariff impacts and improve competitiveness.

We also welcome you to contact us at any time for the latest pricing, lead times, or customized product solutions.

DATA FROM@mysteel.com