January Tinplate Market Report from RIC PACKAGE

Dear friend, the following is our monthly market report update, for your reference.Theme:

Soaring Tin Ingot Prices Drive Strong Tinplate Increases; Complex Market Fluctuations Lead to

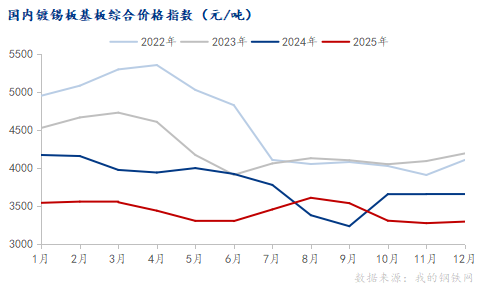

Chaotic Costs in the Metal Packaging Market.1.Tinplate Price Changes:

Baosteel, WISCO, and Meisteel increased tinplate prices by 220 RMB/ton; chromium-coated steel prices remained unchanged.

Other steel mills raised prices by 250-350 RMB/ton and reserved the right to adjust prices further based on tin ingot price fluctuationsThe hot-rolled coil market is showing signs of activity, seeking opportunities for price breakthroughs in the futures market. Baosteel announced a 100 RMB/ton price increase for hot-rolled coil effective in February. Market feedback indicates current spot market prices have risen by nearly 190 RMB/ton.

Simultaneously, coal and coke prices are also gearing up for increases, though this has not yet been reflected in the spot market.

|

2.Tin Ingot Market Driving Tinplate Price Increases:

Tin ingot prices have surged significantly since the beginning of 2025, leading to a new pricing method for tinplate where the tin coating cost is settled based on tin ingot futures prices.

From August 2025 to now, tin ingot prices have risen over 30%, currently reaching 346,890.00 RMB/ton. The market now believes prices could continue rising to 400,000 RMB/ton, with some companies even beginning to prepare for a scenario of 500,000 RMB/ton.

In the short term, price changes in tin ingots, coupled with fluctuations in raw materials like hot-rolled coil and coke, will significantly impact tinplate prices. This is creating a peculiar tinplate price boom despite a generally inactive market.

3.Market Dynamics

3.1 The RMB exchange rate hit a new low, with USD/RMB falling from around 7.30 in July 2025 to the current level of 6.90. The market expects it may further decline to a new low of 6.80. This will continue to push up the FOB USD quotes for Chinese exports.

3.2 On December 23, 2025, Shougang Jingtang successfully produced 0.11mm ultra-thin gauge tinplate, breaking the previous design limit of 0.12mm. All performance indicators met standards, achieving key technological breakthroughs like high-speed online edge trimming and setting a new record for Shougang’s thin-gauge tinplate production.

3.3 On the morning of December 29, 2025, Sanbao Group’s Cold-Rolled Silicon Steel Phase I project——the No.1 six-stand tandem acid pickling line and the silicon steel annealing & coating line——successfully completed trial runs, with the first coil of qualified cold-rolled product successfully produced. Upon full operation, the annual capacity is expected to reach 2.5 million tons, mainly producing high-end silicon steel and tinplate products.

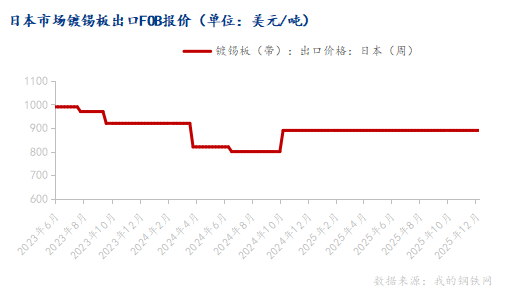

3.4 Japanese tinplate export price focus has shifted upwards. The current export FOB quote is 890 USD/ton, unchanged week-on-week.

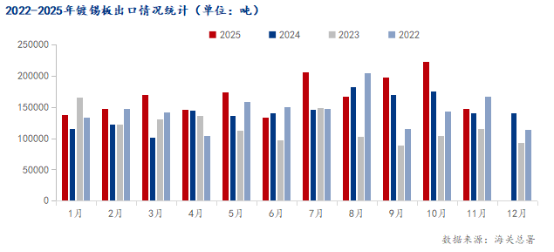

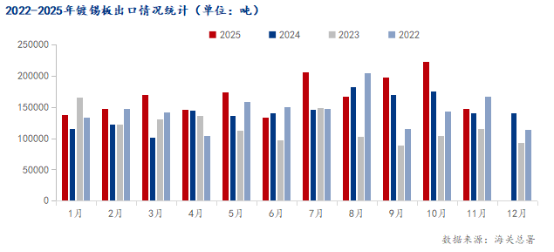

3.5 China’s Export/Import Data (November 2025):

Tinplate Export: 147.4k tons in November, a year-on-year increase of 4.75%; total Jan-Nov 2025 reached 1,847.4k tons, a year-on-year increase of 17.44%.

Tinplate Import: 283 tons in November, a year-on-year increase of 91.35%; total Jan-Nov 2025 reached 4,157 tons, a year-on-year decrease of 77.53%.

Chromium-Coated Steel (TFS) Export: 40.9k tons in November, a year-on-year decrease of 3.26%; total Jan-Nov 2025 reached 523.9k tons, a year-on-year increase of 27.39%.

Chromium-Coated Steel (TFS) Import: Approximately 3 tons in November, a year-on-year decrease of 89.11%; total Jan-Nov 2025 reached 1,050 tons, a year-on-year decrease of 78.92%.

Overall, tinplate exports maintained growth in November. According to the joint Announcement No. 79 by the Ministry of Commerce and the General Administration of Customs, an export license management system will be implemented for certain steel products starting January 1, 2026. It is expected that December’s foreign trade data will show strong performance.

3.6 Domestic Production Data (Jan-Nov 2025, National Bureau of Statistics):

Beverage production by large-scale enterprises reached 165,606k tons, a year-on-year decrease of 4.59%. November production was 10,457k tons, down 5.26% year-on-year.Dairy product production reached 26,850k tons, a year-on-year decrease of 0.36%. November production was 2,431k tons, down 1.46% year-on-year.

4.China Implements Tinplate Export Licensing from 2026:

Policy Overview:

China’s Ministry of Commerce and General Administration of Customs will require export licenses for specific tin mill products starting January 1, 2026 (Announcement No. 79). The regulation covers 4 key HS codes, including:

Tin-coated non-alloy steel wide flat-rolled products (thickness ≥ 0.5mm, width ≥ 600mm)

Tin-coated non-alloy steel wide flat-rolled products (thickness < 0.5mm, width ≥ 600mm)

Tin-coated iron or non-alloy steel narrow flat-rolled products (width < 600mm)

Chromium oxide-coated iron or non-alloy steel wide flat-rolled products (width ≥ 600mm)

The stated objective is to strengthen export monitoring and quality tracking, in compliance with WTO rules, without setting export quotas.

4.1 Current Export Status & Risks:

China’s tinplate exports have shown a consistent growth trend over the past five years. However, sustained high volumes coupled with potential price declines significantly increase exposure to global trade remedies. The industry has faced over 50 anti-dumping cases since 2024, making tinplate a high-risk category for “low-price dumping” investigations in key markets.

4.2 Market Impact

Following implementation, small and medium-sized producers and non-compliant trading firms reliant on proxy export practices will face pressure to transform. Compliant enterprises will benefit from a fairer market environment, helping to curb disorderly low-price competition.

The core of this new regulation lies in shifting exports from a “relatively free” state to a “managed and reviewed” state, which will trigger a series of chain reactions in compliance, costs, and market structure.

The policy proactively regulates the export volume and pace of high-friction-risk products, helping to avoid intensified external countermeasures and reduce the probability of escalating trade conflicts. From a regional export perspective, tinplate may continue to face pressure as a category prone to trade friction.

5. Turkey Issues Final Anti-Dumping Ruling on Tinplate Coils from China and Others

On December 20, 2025, the Turkish Ministry of Trade issued Announcement No. 2025/40, making an affirmative final anti-dumping determination on tin-coated iron or non-alloy steel flat-rolled products originating from Germany, China, South Korea, Japan, and Serbia. It decided to impose anti-dumping duties based on CIF value (see attached table), with rates for China ranging from 23.88% to 50.08%. The measure takes effect from the date of the announcement and is valid for five years.

Summary:

As China’s production and export of tinplate continue to rise, tinplate, as a product prone to trade disputes, has become an inevitable focal point. Simultaneously, the international market cannot completely decouple from Chinese tinplate supply. This situation persists and continues to impact the supply chains of every global buyer.

We anticipate that tinplate prices will continue to reach new highs over the next 1-2 months, coinciding with China’s traditional Spring Festival, and this trend may persist until May-June 2026.

Meanwhile, we are initiating discussions with more clients about price-lock mechanisms. Amid the ongoing global market uptrend, we welcome you to lock in quarterly or semi-annual orders with RIC PACKAGE. RIC PACKAGE will assume the exchange rate and raw material price risks, allowing us to secure your supply and help you stay ahead of the competition to gain greater market share.

|